Equity is a hot topic in the startup world, and there’s no perfect answer for how much equity to give away in a seed round. Advisors, investors, and entrepreneurs all have different perspectives on the matter.

Some startups choose to give away a lot of equity in order to attract investors, while others try to hold on to as much equity as possible. No matter what you decide, it’s important to make sure that you are getting something in return for your equity stake. For example, you can offer investors perks like voting rights or board seats.

At the end of the day, it all comes down to what makes the most sense for your company. However, quantifying the worth of your firm, also known as its valuation, is one of the best tools to measure the share value.

However, startup valuation is never an easy task for any company. So, if you want your startup to be a masterpiece, you need artistic thinking to assess value. But how do you do that? Well, the answer is simple: CoffeeMug.ai.

CoffeeMug.ai is a highly acclaimed networking platform intended to engage entrepreneurs, investors, business leaders and people alike. This digital AI driven platform emphasises on making and developing genuine connections along with helping the young entrepreneurs in generating startup money and shaping their business.

How much equity to give investors in seed rounds?

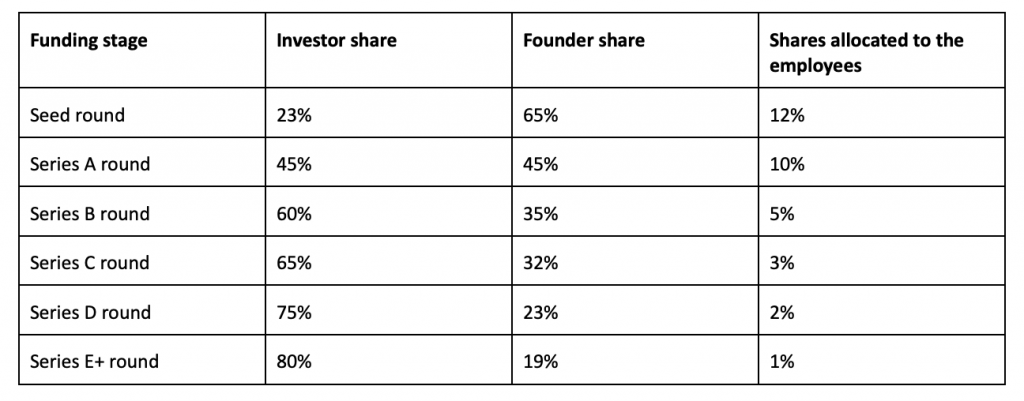

The equity distribution typically depends on the stages of funding. Therefore, with the progress of the funding rounds, you will observe the shifts in equity as shown in the table below:

How to value your startup?

Putting a value on a company is a difficult task, the process becomes even more challenging for a startup with no performance analysis, financial records and past income and expenditure statements. More often, while evaluating your startup, you need to answer the following questions:

- How much startup money or fund do you need to raise?

- Determine how much of your business you want to sell?

How much startup money or fund do you need to raise?

Some industry experts recommend you to raise as much money as possible. But, raising more funds than needed is also too dangerous. This is because higher valuations are linked to higher expectations. Getting more finance usually entails doing more due diligence and accepting more control provisions from investors. This, by default, will increase the pressure on you to generate profit more quickly.

Experts at Coffeemug.ai recommend defining critical milestones and raising funding in tandem with each milestone’s success. A milestone is a measurable accomplishment, such as product development, staff expansion, or market recognition of your company’s value offer.

For example, a startup company launching a mobile app will define the following milestones:

- 1 to 6 months – Develop the app

- 6 to 8 months – Launch the app

- 8 to 10 months – Hit 500 users

- 10 to 12 months – Hit 1000 users and start charging

- 12 to 15 months – Collaborate with major distributor and so on

These are all milestones. Some are more significant than others, and an investor will likely want to discuss the relevance of each one with you in order to get a sense of which ones are the most necessary to focus on in order to assess if your firm will ‘take off.’

The logic for this is simple here: the ideal time to initiate fund raising is RIGHT BEFORE or SOON AFTER a key or set of key milestones are completed successfully.

Determine how much of your business you want to sell?

Angel investors, also called “angels” are often veteran entrepreneurs who understand the level of risk involved and are comfortable taking it on. More often, the general rule when it comes to how much equity do angel investors get is between 10% to 20%. These numbers are calculated based on what an early-stage venture capitalists or an angel investor is looking for in terms of profit.

Since angels are willing to take high-risk chances with your startup, they will likely have a significant stake in the company and obtain a large ROI if things go well. They also want to have a significant say in the company’s strategic decisions if things don’t go well.

There are also various other factors to consider while evaluating your company, as listed below:

- Post-Money Valuation: This refers to the type of valuation taking place after one funding round. The sum includes pre-money valuation, plus the value of the company before an investment round and the value of fresh equity.

- Last Preferred Price: The price that an investor pays for one share during the recent round of investment is known as the last preferred price. This plays a key role in determining the level of success for the startup.

- Strike Price: To exercise the options, you need to determine a value for one share. This is known as the strike price. Mostly, the company prefers to distribute the right share options for its employees.

- Exit Value: This is more precisely known as the hypothetical exit value or simply an estimated amount at which the company assets can be sold. However, it is not usual for a startup to declare such a price. So, a thorough market analysis is must in order to calculate the correct price.

- Number of Options: This simply refers to the amount of shares that you have the right to purchase.

How can connecting with CoffeeMug.ai be beneficial?

Startup valuation is often difficult due to lack of data. As a result, consulting and networking with as many people as you can like investors, and analysts might be beneficial. Coffeemug.ai uses a patented AI-based matchmaking technology to facilitate seamless connections and set up virtual video conferences amongst stakeholders. Their professional platform focuses on catering to the top three requirements of the startup ecosystem, which are employment, investment and network building. Get connected with CoffeeMug.ai today.

FAQs

Q. What is angel equity?

A. Angel investment is a type of equity financing in which the investor provides funds in exchange for a share of the company’s ownership. Angel investors bridge the gap between the small-scale financing offered by family and friends and venture capitalists’ large-scale financing.

Q. What percentage do angel investors get?

A. Typically, angel investors want to get 20% to 25% of their profit. The amount you pay your angel investors, on the other hand, is determined by your first contract.

Q. Does angel investors get equity?

A. Angel/seed investors can only invest in stock because the firms they target are in their early phase of development. They could use SAFE, or Simple Agreement for Future Equity, in very early-stage deals, which is a different kind of convertible note.

Q. Do angel investors help startups?

A. Yes, angel investors help startups. First, they may use their social network to find direct deals or investment possibilities in businesses. The angel round is the initial round of investment for any startup.