CoffeeMug today is a rapidly growing community of over 2,50,000 founders, investors and business leaders. As the economy struggles with the third wave, we conducted a survey on funding sentiment amongst our founder base. Considering the fact that the Covid wave last year had derailed multiple funding and expansion plans, we thought it would be extremely helpful for the founder and investor community to know the real overall funding sentiment in the market.

Respondent Base

41% of the respondents are at idea/MVP stage, 21% at product market fit stage and 31% at growth stage. A large percentage of the respondents are trying to raise funds for the first time for their start up.

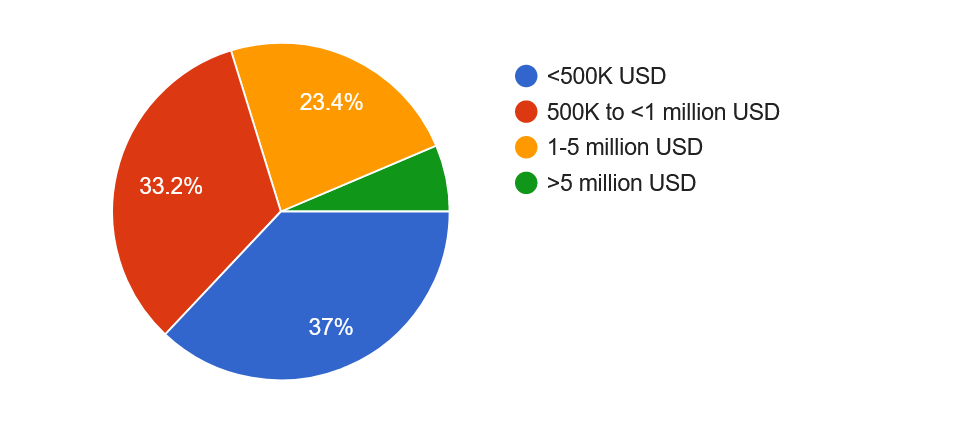

Quantum of Funding Asks

37% of the founders are seeking to raise <500 K USD, 33% between 500 K to 1 million USD and 25% between 1 to 5 million.

Founders’ Perspective

It was heartening to note that 79% of the founders trying to raise funds feel that Omicron has not derailed their plans and 85% don’t plan to reduce their round size because of the fear of Omicron wave. 45% of the respondents amongst founders have a high degree of confidence that they will be able to close their round of funding in the next 3-6 months. Even among the founders who are not trying to raise funds currently, 60% believe that the founders trying to raise funds will not face an issue due to Omicron wave.

Founders are mostly bullish with a small segment sounding a note of caution. Rajat Tuli, Co-Founder – Ustraa says, “The investor sentiment has not been affected as it was the last time. Things are as good as they were pre covid. Speaking of investors raising funds, my feeling is that there are more options than ever before. Maybe because a few start-ups went public or because employees could liquidate their options the belief in investing in start-ups is getting bigger. This is a suitable time to raise.”

Daniela Gheorghe, CEO and Co-Founder – Hum shares, “Depends on the type of sector you are playing in. We are building for digital creators in emerging markets, who are not affected. Digital-first tech start-ups are not affected, the digital wave that covid stirred is a boon. Move on and stop waiting for covid to end. It will take a long time before that happens.”

Chat with Investors

We also got some perspective from some respected VCs who share a similar sentiment that Omicron has not derailed investment plans.

Abhishek Surendra, Co-Founder T2D3 Capital says, “From a VC’s perspective, I believe that Omicron has not impacted investment ecosystem much and it is almost same especially for the start-up sector. There have been no major changes in both investment side as well as portfolio segment. Market was a little down in 2020 but now things are better. Founders don’t need to do anything different from what they were doing from last 1-2 years, but the ecosystem has changed a little and investors are now looking for new ideas. While market traction is still something investors look up to, their focus has now shifted more to spaces like crypto, NFT etc.”

Gauri Kuchhal, Principal – Artha Venture Fund, says, “I believe omicron is a small hurdle but not anything we can’t overcome from. We are still actively looking for more proposals and businesses to invest in. Also, right now we are working with start-ups and helping them conserve cash at this time, but it is not a major setback and there’s no need to panic. Thanks to covid, tech has now become more prominent, and we are searching for more such start-ups.”

Angel investors are also feeling bullish. Ashim Jolly, Angel investor IBEC India, ex WeWork, Haptik says, “I don’t think that omicron has impacted investor sentiment. I don’t mind investing even at this time and have no second thoughts as the stats show that there are still many investment related activities going on in the market. I would like to do sector agnostic investments and founders really don’t need to do anything and just focus on their business.”

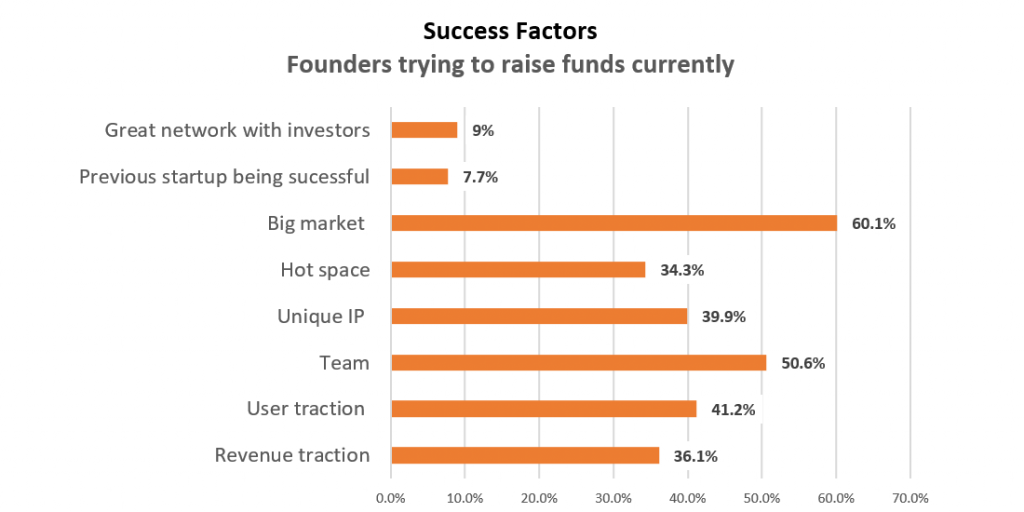

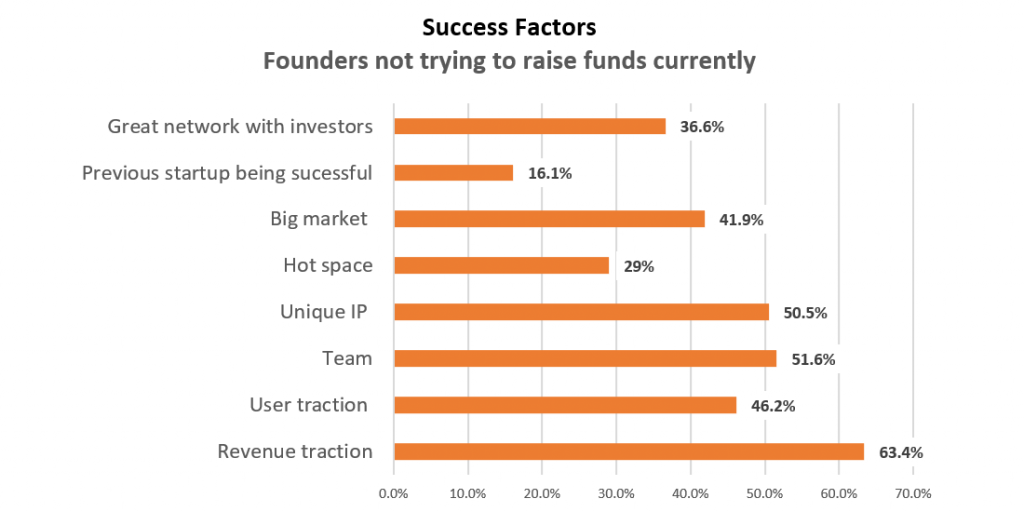

Factors Founders Attribute to Success

Coming to the factors which founders trying to raise funds feel they will attribute their success to, the top 5 vote shares go to big market (60%), team (50%), user traction (41%), unique IP (40%) and revenue traction (36%). This is also an interesting learning for aspiring founders.

Interestingly, the graph is a little different for founders not raising funds currently. There, the top five vote shares go to revenue traction (64%), team (52%), unique IP (51%), user traction (46%) and big market (42%). So, revenue traction is very important in the eyes of others.

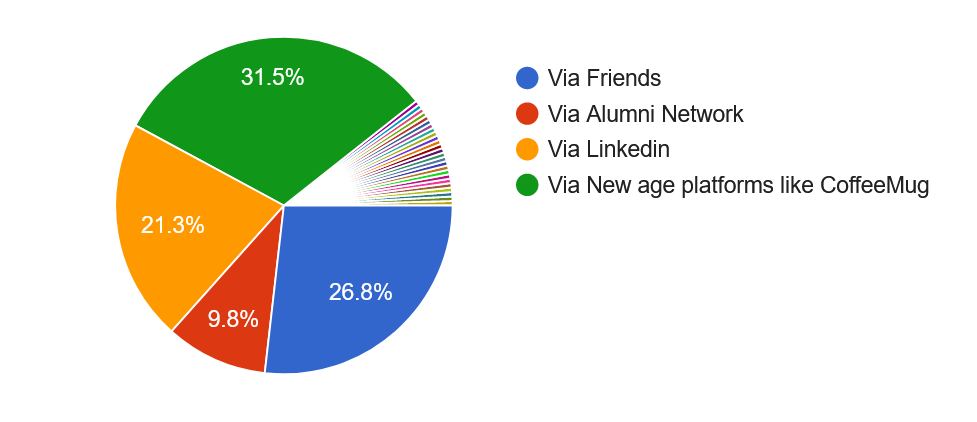

How to connect with Investors

It is also extremely interesting that know that of the routes being attempted to connect with investors, new age platforms like CoffeeMug score the highest.

Member Speak: Venture Catalysts

“From a VC’s perspective, I believe that Omicron has not impacted the investment ecosystem much and it is the same, especially for the start-up sector. There have been no major changes in both the investment side as well as portfolio segment. The market was a little down in 2020 but now things are better. Founders don’t need to do anything different from what they were doing for the last 1-2 years but the ecosystem has changed a little and investors are now looking for innovative ideas. While market traction is still something investors look up to, their focus has now shifted more to spaces like crypto, NFT, etc.”

“From a VC’s perspective, I believe that Omicron has not impacted the investment ecosystem much and it is the same, especially for the start-up sector. There have been no major changes in both the investment side as well as portfolio segment. The market was a little down in 2020 but now things are better. Founders don’t need to do anything different from what they were doing for the last 1-2 years but the ecosystem has changed a little and investors are now looking for innovative ideas. While market traction is still something investors look up to, their focus has now shifted more to spaces like crypto, NFT, etc.”  “Omicron has not impacted investor sentiments at all, and everything is just the same way it was before this. However, I believe that the founders seeking investments should change their strategy and mindset of raising funds. They should show market attraction. First, they should try to sell their product to around 10K people and then come to investors and ask for funding.”

“Omicron has not impacted investor sentiments at all, and everything is just the same way it was before this. However, I believe that the founders seeking investments should change their strategy and mindset of raising funds. They should show market attraction. First, they should try to sell their product to around 10K people and then come to investors and ask for funding.”  “Omicron is a small hurdle but not anything we can’t overcome from. We are still actively looking for more proposals and businesses to invest in. Also, right now we are working with start-ups and helping them conserve cash currently, but it is not a major setback and there’s no need to panic. Thanks to covid, tech has now become more prominent, and we are searching for more such start-ups. Founders need not worry about anything, and the impact of omicron’s situation varies from business to business. It is safe to say that start-ups in the hospitality space should postpone raising funding for a bit and even in this case, if their strategy is well-drafted and they have covered all pros and cons and are ready with their idea, then they also don’t need to worry about anything. The rest of the start-up founders can continue raising funds without any stress as covid is just a temporary setback.”

“Omicron is a small hurdle but not anything we can’t overcome from. We are still actively looking for more proposals and businesses to invest in. Also, right now we are working with start-ups and helping them conserve cash currently, but it is not a major setback and there’s no need to panic. Thanks to covid, tech has now become more prominent, and we are searching for more such start-ups. Founders need not worry about anything, and the impact of omicron’s situation varies from business to business. It is safe to say that start-ups in the hospitality space should postpone raising funding for a bit and even in this case, if their strategy is well-drafted and they have covered all pros and cons and are ready with their idea, then they also don’t need to worry about anything. The rest of the start-up founders can continue raising funds without any stress as covid is just a temporary setback.”  “I think omicron has created both positive and negative impacts on the investment economy, depending upon the sector. For example, FMCG and B2C we have noticed have received a good amount of funding whereas companies in the manufacturing industry and MSMEs are not getting funds these days. We are seeing founders from a different view; you can see their ways have changed a lot from pre covid era to post covid era. Founders trying to raise funds at this time should try working remotely and monitoring the productivity of their company and they should have the tools to function normally even during remote working and see if it affects their growth or not. Also, since most of the sales are happening online these days, B2B companies and other product-based companies should try becoming adept at it and see how they can manage to make sales online.”

“I think omicron has created both positive and negative impacts on the investment economy, depending upon the sector. For example, FMCG and B2C we have noticed have received a good amount of funding whereas companies in the manufacturing industry and MSMEs are not getting funds these days. We are seeing founders from a different view; you can see their ways have changed a lot from pre covid era to post covid era. Founders trying to raise funds at this time should try working remotely and monitoring the productivity of their company and they should have the tools to function normally even during remote working and see if it affects their growth or not. Also, since most of the sales are happening online these days, B2B companies and other product-based companies should try becoming adept at it and see how they can manage to make sales online.” Member Speak: Angel Investors

“Despite Omicron, there is optimism and energy around. The vaccination and the anticipation are this will get over in a few months. And this is the backdrop of investors who also continue to look at and back companies. Investment evaluation is also hybrid now or remote in some cases. some industry verticals and business models offline continue to have a frustrating and painful existence. Doing what they can and surviving this phase. Community – that’s one thing that the past 2 waves have reinforced in all aspects of our lives. Founders, employees, customers, ecosystem, investors, etc. It’s the community that evolves to take care and content +communication has been the bridge for the community to find ways to look beyond.”

“Despite Omicron, there is optimism and energy around. The vaccination and the anticipation are this will get over in a few months. And this is the backdrop of investors who also continue to look at and back companies. Investment evaluation is also hybrid now or remote in some cases. some industry verticals and business models offline continue to have a frustrating and painful existence. Doing what they can and surviving this phase. Community – that’s one thing that the past 2 waves have reinforced in all aspects of our lives. Founders, employees, customers, ecosystem, investors, etc. It’s the community that evolves to take care and content +communication has been the bridge for the community to find ways to look beyond.” “I don’t think that omicron has impacted investor sentiment. I don’t mind investing even currently and have no second thoughts as the stats show that there are still many investment-related activities going on in the market. I would like to do sector agnostic investments and founders really don’t need to do anything and just focus on their business.”

“I don’t think that omicron has impacted investor sentiment. I don’t mind investing even currently and have no second thoughts as the stats show that there are still many investment-related activities going on in the market. I would like to do sector agnostic investments and founders really don’t need to do anything and just focus on their business.”  “Omicron has not created any impact on investor sentiments. I am looking to invest in internet businesses because no matter whether it’s covid or any other situation, these kinds of companies will always help some other businesses. I think that the basic fundaments of raising funds never change and founders can continue doing what they have always done. There are certain sectors which are getting more funding right now, for example, healthcare is where audience and consumers are more, profitability is hence more, and this attracts more investors.”

“Omicron has not created any impact on investor sentiments. I am looking to invest in internet businesses because no matter whether it’s covid or any other situation, these kinds of companies will always help some other businesses. I think that the basic fundaments of raising funds never change and founders can continue doing what they have always done. There are certain sectors which are getting more funding right now, for example, healthcare is where audience and consumers are more, profitability is hence more, and this attracts more investors.”  “I think that the liquidity will expand. The market is currently down, and it is time for people, especially the middle class, to invest in businesses and markets. At this time, start-up funding will increase, and deals closure will increase by 40-50%. However, there’s an estimation that in April, the US market will crash and if this happens then people will not invest. I am looking for start-ups in web3.o or crypto space to invest in and have no second thoughts, in fact, it is the suitable time to do investment. Founders who are seeking pre-stage funding will be in more advantage as compared to those who are in their second round of fundraising as covid impacted their performance last year.”

“I think that the liquidity will expand. The market is currently down, and it is time for people, especially the middle class, to invest in businesses and markets. At this time, start-up funding will increase, and deals closure will increase by 40-50%. However, there’s an estimation that in April, the US market will crash and if this happens then people will not invest. I am looking for start-ups in web3.o or crypto space to invest in and have no second thoughts, in fact, it is the suitable time to do investment. Founders who are seeking pre-stage funding will be in more advantage as compared to those who are in their second round of fundraising as covid impacted their performance last year.”  “Omicron has not affected the investor sentiments as per my opinion. I don’t mind investing even at this time and right now I have also invested my money in stock markets. I am interested in investing in technology companies no matter what industry. My primary focus is on investing in companies that provide solutions to the problems of others, no matter how big or small. I don’t think that founders need to do anything new for raising funds.”

“Omicron has not affected the investor sentiments as per my opinion. I don’t mind investing even at this time and right now I have also invested my money in stock markets. I am interested in investing in technology companies no matter what industry. My primary focus is on investing in companies that provide solutions to the problems of others, no matter how big or small. I don’t think that founders need to do anything new for raising funds.”  “I think omicron has created an impact. Investors who have been investing for a while have now increased their investment and people who are well experienced and stable in their career are moving towards investing in equities and mutual funds as they have realized that in today’s time, only one source of income would not be sufficient. Moreover, people have stopped investing in real estate these days and focusing more on equities and mutual funds because they need liquid cash, and the rate of interest and returns are higher in mutual funds and equities. Investors are also putting their money more in bond funds, especially in government organizations as it falls under the safety net along with the equities. I am interested in investing in any sector and have no second thoughts, in fact, I have increased my investments inequities. Founders need to focus more on justifying the profitability of their product than just showing that their idea is unique.”

“I think omicron has created an impact. Investors who have been investing for a while have now increased their investment and people who are well experienced and stable in their career are moving towards investing in equities and mutual funds as they have realized that in today’s time, only one source of income would not be sufficient. Moreover, people have stopped investing in real estate these days and focusing more on equities and mutual funds because they need liquid cash, and the rate of interest and returns are higher in mutual funds and equities. Investors are also putting their money more in bond funds, especially in government organizations as it falls under the safety net along with the equities. I am interested in investing in any sector and have no second thoughts, in fact, I have increased my investments inequities. Founders need to focus more on justifying the profitability of their product than just showing that their idea is unique.” Member Speak: Founders

“I do not think that Omicron has had any impact on investor sentiment or on funding interest in startups. Long term prospects for India remain strong and Omicron will not change that. If anything, digital adoption will continue to sustain its strong momentum, which will benefit tech companies. More than Omicron, rising interest rates is what has the potential to change the current dynamic of startup fundraising. In the recent past, public market tech stocks have taken a beating and the effect of that will at some point spill over into the private markets and we are likely to start seeing valuations getting impacted. I would advise founders to accelerate fund raising plans if they have any and for those in discussions, to close early.”

“I do not think that Omicron has had any impact on investor sentiment or on funding interest in startups. Long term prospects for India remain strong and Omicron will not change that. If anything, digital adoption will continue to sustain its strong momentum, which will benefit tech companies. More than Omicron, rising interest rates is what has the potential to change the current dynamic of startup fundraising. In the recent past, public market tech stocks have taken a beating and the effect of that will at some point spill over into the private markets and we are likely to start seeing valuations getting impacted. I would advise founders to accelerate fund raising plans if they have any and for those in discussions, to close early.”  “The investor sentiment has not been affected as it was the last time. Things are as good as they were pre covid. Speaking of investors raising funds, my feeling is that there are more options than ever before. Maybe because a few start-ups went public or because employees could liquidate their options the belief in investing in start-ups is getting bigger. This is a suitable time to raise.”

“The investor sentiment has not been affected as it was the last time. Things are as good as they were pre covid. Speaking of investors raising funds, my feeling is that there are more options than ever before. Maybe because a few start-ups went public or because employees could liquidate their options the belief in investing in start-ups is getting bigger. This is a suitable time to raise.”  “Omicron has not affected the investor sentiments. It has in fact affected fundraising in a positive manner. Industries are getting more dynamic and diversity across organizations is increasing due to which attracting foreign investors has become easier. I think that opportunities have opened in quite a different manner and lots of different industries and domains have opened which have introduced different possibilities and ways of raising funds.”

“Omicron has not affected the investor sentiments. It has in fact affected fundraising in a positive manner. Industries are getting more dynamic and diversity across organizations is increasing due to which attracting foreign investors has become easier. I think that opportunities have opened in quite a different manner and lots of different industries and domains have opened which have introduced different possibilities and ways of raising funds.” “Depends on the type of sector you are playing in. We are building for digital creators in emerging markets, who are not affected. Digital-first tech start-ups are not affected, the digital wave that covid stirred is a boon. Move on and stop waiting for covid to end. It will take a long time before that happens.”

“Depends on the type of sector you are playing in. We are building for digital creators in emerging markets, who are not affected. Digital-first tech start-ups are not affected, the digital wave that covid stirred is a boon. Move on and stop waiting for covid to end. It will take a long time before that happens.”  “Omicron has not impacted anything, and everything is going on well, especially if you are working remotely. It depends on business to business on how to raise funds, as I am building a company in digital space, so everything right now is smooth.”“Omicron has not impacted anything, and everything is going on well, especially if you are working remotely. It depends on business to business on how to raise funds, as I am building a company in digital space, so everything right now is smooth.”

“Omicron has not impacted anything, and everything is going on well, especially if you are working remotely. It depends on business to business on how to raise funds, as I am building a company in digital space, so everything right now is smooth.”“Omicron has not impacted anything, and everything is going on well, especially if you are working remotely. It depends on business to business on how to raise funds, as I am building a company in digital space, so everything right now is smooth.” “I think yes, Omicron has moderately impacted the funding for businesses in a negative way because nobody likes to invest money during uncertain times. Founders should do more sharpening of their product at this time; they should be having pre-revenue traction to showcase how one can create opportunities in tough times.”

“I think yes, Omicron has moderately impacted the funding for businesses in a negative way because nobody likes to invest money during uncertain times. Founders should do more sharpening of their product at this time; they should be having pre-revenue traction to showcase how one can create opportunities in tough times.” “Omicron has impacted funding very slightly, but it is not a major setback. These are uncertain times and founders need to change their way of thinking compared to the way they used to think before December. They should be heavily prepped up for the digital future. Even if they are running a traditional business, they should keep a digital strategy on the top of their head.”

“Omicron has impacted funding very slightly, but it is not a major setback. These are uncertain times and founders need to change their way of thinking compared to the way they used to think before December. They should be heavily prepped up for the digital future. Even if they are running a traditional business, they should keep a digital strategy on the top of their head.”  “Essentially I would say that omicron’s situation has catalyzed the growth of few businesses. For example, companies that were into digitalization and digital transformation have a great boost. The current situation has been a great accelerator for them, and these kinds of businesses have attracted lots of investors. I don’t believe that founders need to do anything new or different because the fundamental philosophy of investors always remains the same. Founders should continue focusing on doing what they have always done. That is – showing a formidable team, strong vision, execution capabilities, market traction, and so on.”

“Essentially I would say that omicron’s situation has catalyzed the growth of few businesses. For example, companies that were into digitalization and digital transformation have a great boost. The current situation has been a great accelerator for them, and these kinds of businesses have attracted lots of investors. I don’t believe that founders need to do anything new or different because the fundamental philosophy of investors always remains the same. Founders should continue focusing on doing what they have always done. That is – showing a formidable team, strong vision, execution capabilities, market traction, and so on.”Insights over coffee

You are Correct! More than 50% of the founders say there

will be no impact on fund raising due to Omicron.

Insights over coffee

Oops, not a correct guess! More than 50% of the founders say there

will be no impact on fund raising due to Omicron.