Startups have great potential to generate substantial revenue for investors. Investing in early-stage startups allows an investor to reap maximum benefits from a startup’s ideas. However, not every business venture succeeds. Many of them appear to have good ideas but fail to put them into practice adequately.

When it comes to investing in a startup, investors are smart because they want their money to grow and flourish. As a result, it’s critical to understand what investors are looking for in businesses before investing time and money. The Coffeemug.ai team have outlined what investors should look for when prospecting companies and which investment criteria are most important?

Important criteria for investment in startups:

Innovative Ideas

Today’s investors are looking for unique ideas with innovative answers to real-world issues. When modern technology is used in the solution, it increases the chances of success.

Market opportunities

Even if a prototype or sample version of the project has been established, it is vital to test its feasibility on a bigger scale. For example, whether the cost of creating a single product is too expensive. Can economies of scale be integrated into your operations to boost margins and profits?

Product uniqueness

With so many products on the market, there’s a strong chance that the product the startup is planning to consider is already doing well. Therefore, it is critical for the investors to understand how the product differs from others in the market, what competitive advantages it has over competitors, and how it will cater to the market in a unique way.

Scalability

If growth to international markets is not feasible, investors are often left with a low appreciation margin, which is often uninteresting to them. The fundamental principle of a startup is that it should be able to expand swiftly, ideally all over the world. Invest in businesses that are built with scalability and adaptability, for both the short and long term.

Market potential

One of the important criteria for investment in startups is to evaluate the product’s market potential as well as the level of competition. These two factors indicate whether there is market demand, who and what the true competition is, what are the obstacles, how long a product would take to establish itself, how quickly it could expand, and so on.

Organized team and management

A company that has put together a team, whose individuals have relevant experience and have been given the responsibility to handle their respective areas of operation is often considered the best bet for investment.

Look for a startup that has a good team and product. Is there a roadmap and how does the company handle its social media accounts? What’s the team attitude? All these factors give you a clear picture of how serious the company is about achieving its goals.

Plan of exit

When it comes to investing in startups, investors need to keep in mind two main financial concerns: how much money do they need to invest and when do they need to invest it. Also, how much money will they get back and when? A thorough financial estimate can answer both of these questions. Investors must look for the following projections:

- A detailed explanation of the model’s assumptions

- Company’s financial statements such income statement, balance sheet, cash flow statements and so on

- A return on investment (ROI) analysis

- Report on cash sources and uses

Conclusion

Coffeemug.ai is a professional networking platform designed to offer insight and expertise for entrepreneurs as well as investors who are passionate about bringing a change in the startup ecosystem with their innovative ideas and money. Whether your goal is to secure funding, sell your company, or generate profits, our AI-powered algorithm will match you with the right partner and guide you through the entire process.

For further information on what should I look for when investing in a startup? Join our community today.

FAQs

Q. Which investment criteria are most important?

A. Revenue growth, value-added of product/service, and management team track record are considered as the three main startup investment criteria.

Q. What is the criteria and investment strategy?

A. The phrase “investment plan” refers to a set of guidelines designed to assist a single investor in achieving his or her financial and investing objectives. This plan directs an investor’s decisions based on certain objectives, risk tolerance, and future capital requirements.

Q. What are the investment criteria?

A. The set of metrics used by financial and strategic owners to evaluate an acquisition target is known as investment criteria.

Q. What is a startup investment?

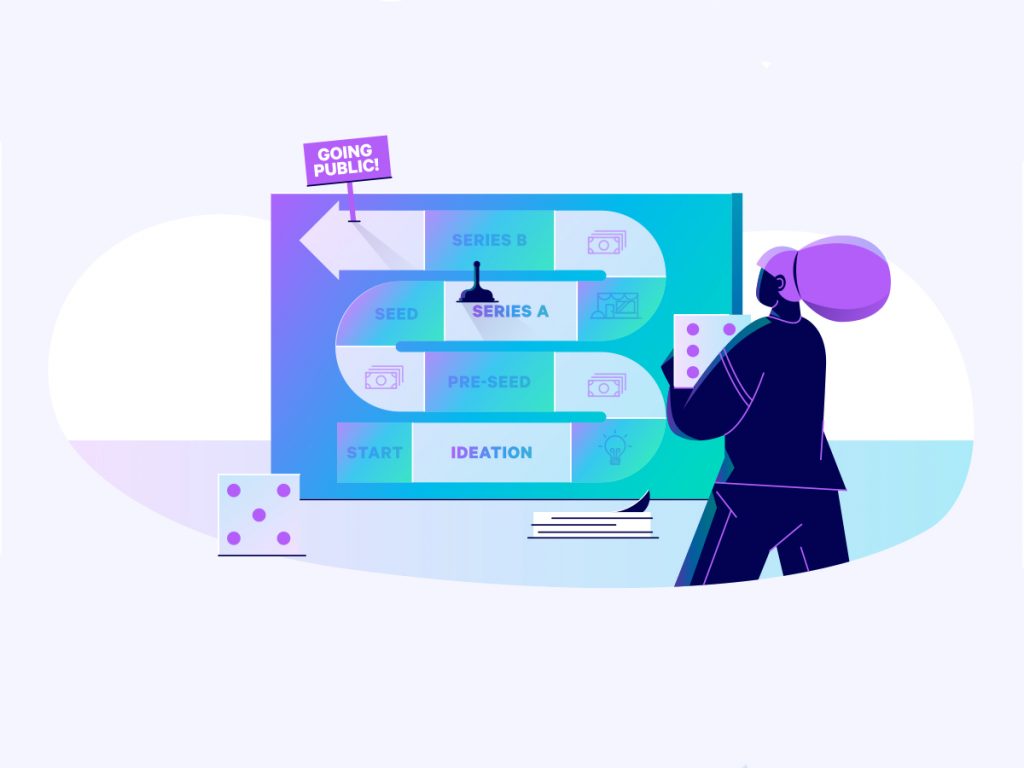

A. Making an early-stage investment in a startup is known as startup investing. Some startups, in addition to the funding from the founders, raise additional capital at one or more stages of their development.

Q. What do investors look for before investing in a startup?

A. Market size, team capability, traction, investor fit, competitive advantage, and comprehensive business plan are some of the parameters that investors look for before investing in a startup.